On January 10th, the FHA lowered its annual mortgage insurance premium (MIP) by 25 basis points. That decision was put on hold pending a review on January 21st. This alteration to the FHA’s fee structure was unique as it made many borrowers in the current pipeline eligible for the fee reduction. NAR Research surveyed a panel of mortgage originators to gain insights on the impact of the change to consumers and the market. The respondents felt that the impact would be small in part due to the time of year, but many borrowers would be inconvenienced, some incurring expense, and a few no longer eligible to purchase a home.

Highlights form the survey:

- Respondents indicated that a range of 1 percent to 40 percent of their pipeline would be impacted with a weighted average of 15.1 percent

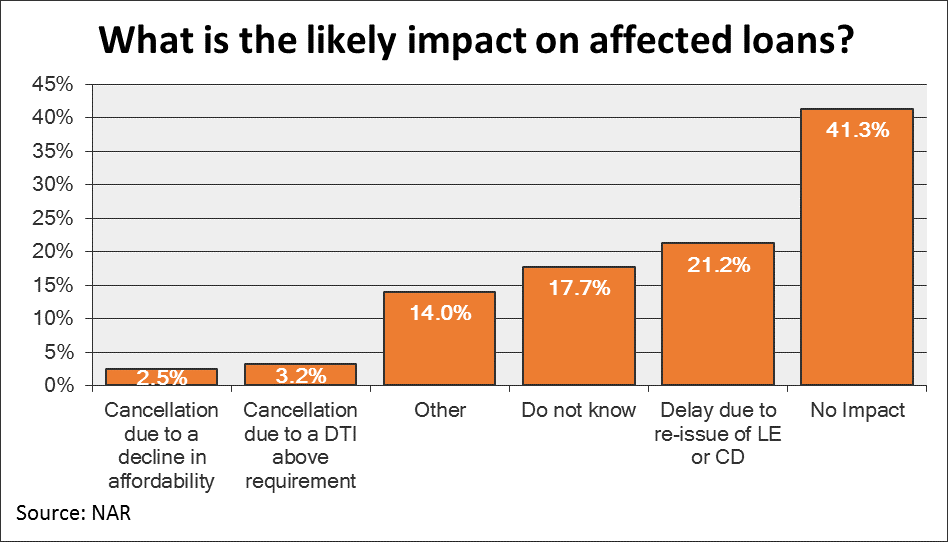

- Of those affected, 5.7 percent of the affected loans will likely be cancelled, while 21.2 percent will be delayed as loan estimates (LE) or closing disclosures (CD) are reissued. This implies that roughly 0.86 percent of all mortgage production could be cancelled, in line with earlier NAR estimates.

- Half of respondents indicated that consumers would absorb the higher MIP, while 22.2 percent said their firm would absorb a rate lock extension. One respondent indicated that consumers would absorb both costs.

- Overall, lenders were optimistic that the impact would be limited in part due to the time of year, but for some that was not the case.

The suspension of the FHA’s fee reduction provides important lessons for how to inform the market of such changes. Furthermore, with the fee under review, many homebuyers may still benefit from a future reduction in the fee.

Powered by WPeMatico