A year after implementation of the Know Before You Owe rule, many REALTORS® expressed both support, but also frustration. The TILA-RESPA Integrated Documentation (TRID) or Know Before You Owe rule went into effect on October 3rd 2015. In early September, NAR Research surveyed nearly 2,500 REALTORS® to get their perspective on the impact of Know Before You Owe one year after implementation. This survey reviews REALTORS® experiences in the 3-month period prior to the 1st anniversary with the 3-month period after implementation (Q4 2015 versus Q3 2016).

In general, the results were positive as delays eased and REATLORS® found new ways to ameliorate the impact of the regulation. However, members remained frustrated with limited access to the closing disclosures (which replaced the HUD-1) and its impact on the relationship between REATLORS® and their clients. Respondents indicate that since implementation:

- Delayed transactions fell from 10.4 percent to 8.5 percent, but cancellations edged up slightly from 0.6 percent to 0.7 percent.

- 45.6 percent of respondents had problems getting closing disclosures down from 54.5 percent.

- However, REALTORS® were more likely to request closing disclosures from title agents than lenders in the 3rd quarter, especially REALTORS® with greater transactions volume.

- On average delayed and canceled transactions cost consumers $410 and $226, respectively. Rental and deposit expenses as well as lost vacation time accounted for most expenses.

- The share of respondents who identified errors on CDs rose from 43.3 percent to 50.6 percent. Missing concessions and incorrect names or addresses were the most frequently cited errors, but incorrect fees, commissions, and taxes were also reported

- Large retail banks were far more problematic than small lenders, mortgage banks, and non-banks

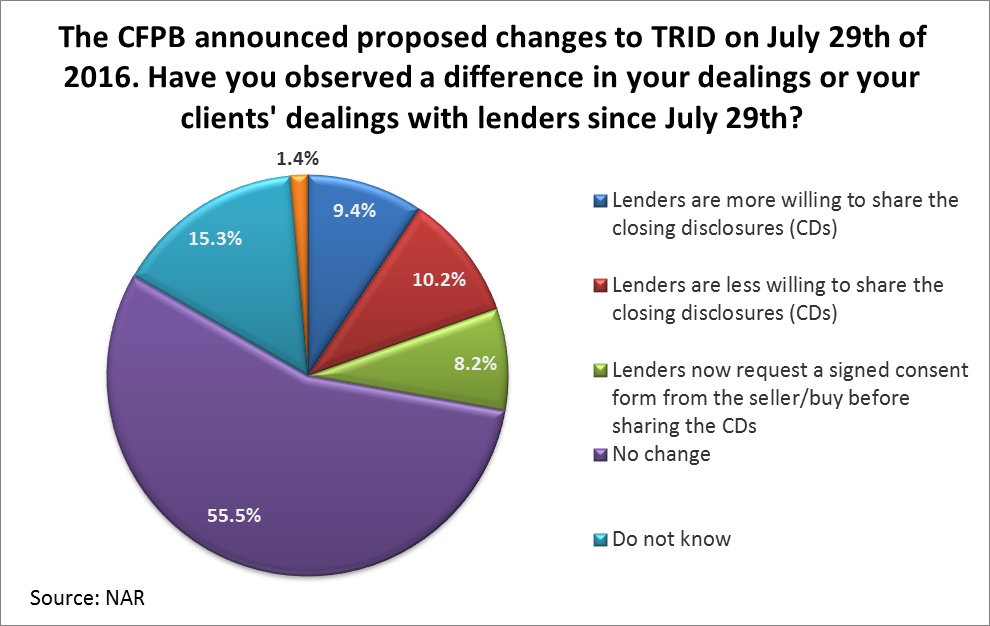

- REALTORS® noted no change in lenders’ willingness to share the closing disclosure following the CFPB’s clarification on CD sharing in late July of 2016. Legal requirements and consumer privacy were most frequently cited when sharing was refused.

In addition to taking the survey, many respondents shared their perspectives on TRID including these thoughts:

“We are creatures of habit and hate changes. Once I had about 3 closings under TRID, it all was like my first closing 13 years ago. I don’t see a problem now…”

“In my opinion the TRID guidelines have reduced the communication between lenders and REALTORS® and it feels like a push to keep us out of the process…”

“I worked 23 years building strong relationships and this new TRID experience has removed me from a lot of the process making me feel my relationships are suffering as a result. The real estate industry, on whole, is suffering from external influences and the client is ultimately the one who loses that great service.”

“My clients often got screwed by their lenders before TRID. They paid outrageous loan fees. This has dropped significantly.”

“Most of the problems come from agents and banks that are unwilling to share the information because it is ‘illegal’. I spend a lot of time arguing that it is not, buyer agrees to share it in contract, vs bank and other agent saying it cannot be shared.”

The market appears to have made steady progress adapting to the new TRID rules and some see value in it. However, frustration driven by change and lack of access to the closing disclosure remains.

Powered by WPeMatico