Three years after the ability to repay (ATR) rule was implemented, the risky mortgage products that became common during the last boom and helped fuel the unsustainable run-up in prices are rare. That is one of the key takeaways from the 12th Survey of Mortgage Originators (SMO) which covers lenders’ insights on trends and policy changes in the 3rd quarter of 2016.

Other insights from the 3rd quarter SMO include:

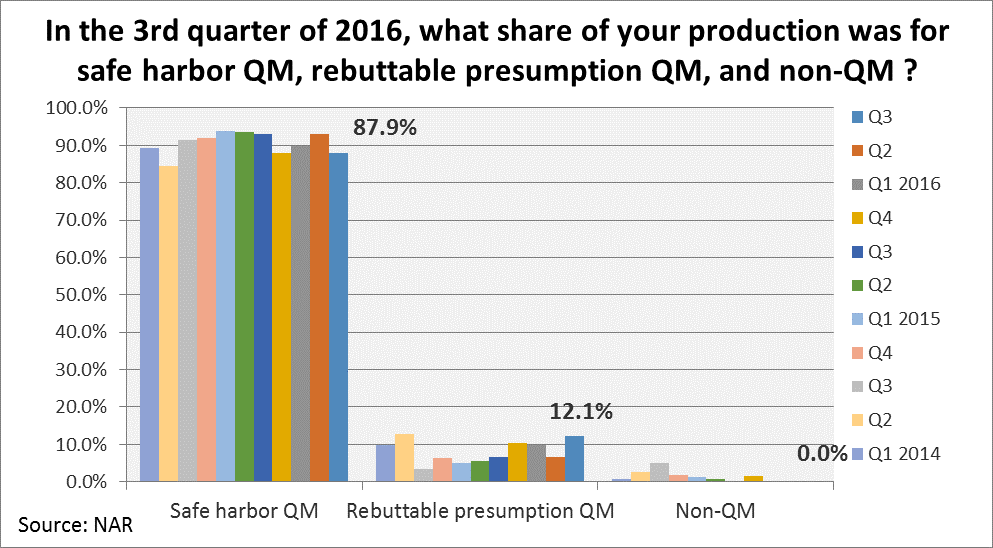

- Non-QM lending has not bounced back from the implementation of the risk retention rule, while rebuttable presumption lending continues to gain ground.

- Credit access for lower-credit prime borrowers is expected to rise while all other categories are likely to moderate.

- The share of transactions delayed due to TRID rose to 2.6 percent, but both TRID and non-TRID cancelations fell.

- More than half of lenders passed TRID-related costs to consumer with a weighted average increase of $220.

- Only 16.7 percent of participating lenders shared the closing disclosure (CD) unconditionally with REALTORS®, while 50 percent did not share under any circumstances.

- 83.3 percent of respondents indicated that the CFPB’s July clarification sharing did not impact their decision to share the CD. Several lenders indicated that more clarification was needed or that they were not aware of the CFPB’s statement.

- The majority of lenders in this survey sold their servicing rights and only 8.3 percent of respondents indicated that servicing was a factor in determining overlays.

Powered by WPeMatico