The following status update on mortgage debt cancellation relief, an important federal tax issue for homeowners, is written by Jon Boughtin of NAR Media.

The 114th Congress recessed in early December without completing work on a so-called “tax extenders” package needed to continue important tax breaks for real estate. This included tax relief for the cancellation of mortgage debt, as well as the deduction for mortgage insurance premiums.

The 114th Congress recessed in early December without completing work on a so-called “tax extenders” package needed to continue important tax breaks for real estate. This included tax relief for the cancellation of mortgage debt, as well as the deduction for mortgage insurance premiums.

Mortgage debt cancellation relief is important for underwater homeowners who, without the provision, would be taxed on mortgage debt forgiven in a short sale. Mortgage insurance premium deductions, likewise, are helpful for a large number of homeowners, particularly first time homebuyers, who lack a 20 percent downpayment when purchasing their home.

The National Association of Realtors® advocated for a tax-extenders package that would extend both of these provisions into 2017, but Congress adjourned without taking further action.

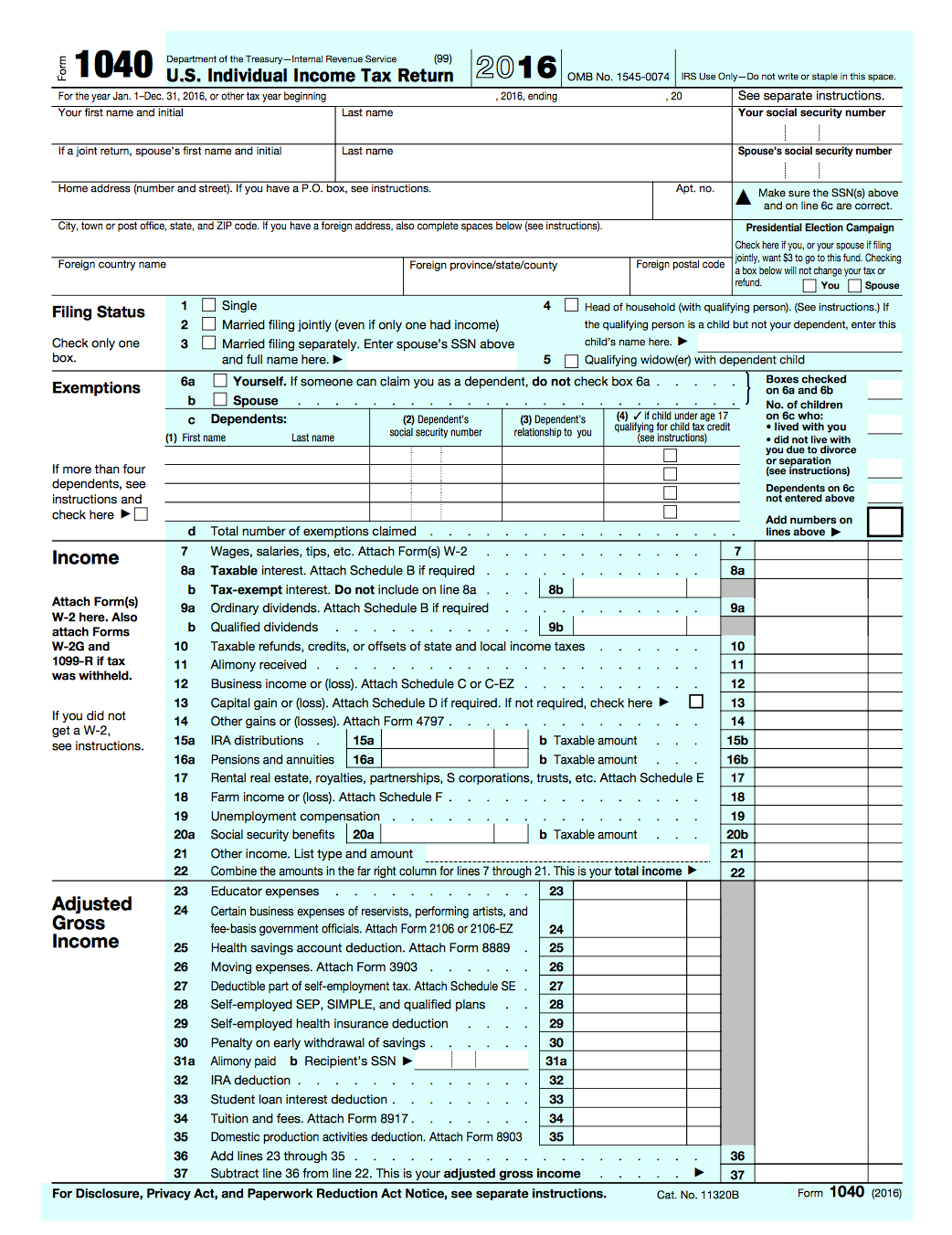

Although these provisions expired at the end of 2016, there is a misconception that they are unavailable to homeowners for the 2016 tax year. Both the mortgage debt cancellation provision and the mortgage insurance premium deduction are available to homeowners filing their 2016 taxes this year.

Further work is required in Congress to extend these provisions into 2017, and NAR is supportive of those efforts.

You can learn more about this issue at NAR.REALTOR.–Jon Boughtin, NAR Media

Powered by WPeMatico