Every month NAR produces existing-home sales, median sales prices and inventory figures. The reporting of this data is always based on homes sold the previous month and the data is explained in comparison to the same month a year ago. We also provide a perspective of the market relative to last month, adjusting for seasonal factors, and comment on the potential direction of the housing market.

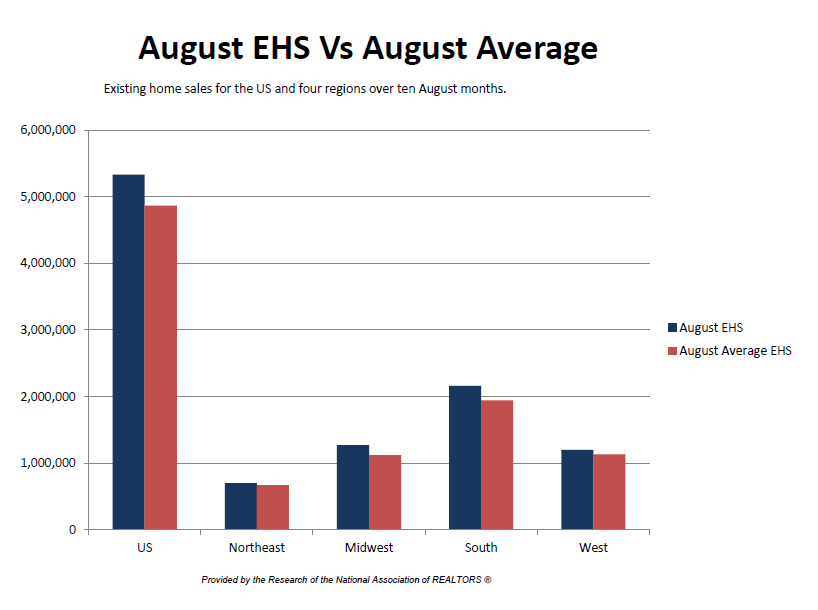

The data below shows what our current month data looks like in comparison to the last ten August months and how that might compare to the “ten year August average” which is an average of the data from the past ten August months.

- The total number of homes sold in the US for August 2016 is higher the ten year August average. Regionally, all four regions were above the ten year August average, while the Midwest and South led with stronger sales.

- Comparing August of 2006 to August of 2016 fewer homes were sold in 2016 in the US and all regions, the Northeast enduring the biggest decline of 51.4 percent. The US had a drop of 18.9 percent while the West had the smallest drop in sales at 8.3 percent over the ten year period.

- This August the median home price is higher than the ten year August average median price for the US and all four regions. The West leading all regions with 14.1 percent growth.

- Comparing August of 2016 to August 2006, the median price of a home increased in all regions. The South led all regions with a gain of 13.8 percent followed by the Midwest with 11 percent. The US had an incline in price of 7.1 percent while the Northeast had the smallest gain of 0.7 percent and the West experienced a modest gain of 1.3 percent.

- Looking at year over year changes, after August 2011 price growth turned positive and maintained momentum thru the current year for the US and four regions. Since 2012 August price growth has been steady, while the Northeast experienced only one decline in 2014.

- The median price year over year percentage change shows that home prices began to fall in 2008 nationally, and prices dipped by double digits in 2009 for all regions with the West having the biggest decline of 12.3 percent in 2009 after an even larger decline of 23.9 percent in 2008. The trend for median home prices turned around completely in 2012, when all regions including the US showed price gains. The following year, 2013, price growth rates peaked and the West had the largest gain in price of 18.3 percent, while the Northeast had the smallest gain at 7.3 percent from 2012 to 2013. This August the West (9.2%) had the highest year over year price change over the US and the other three regions.

- There are currently fewer homes available for sale in the US this August than the ten year August average. This current August the US had the fastest pace of homes sold relative to the inventory when months supply was 4.6 months. In 2010 the US had the slowest relative pace when it would have taken 11.5 months to sell the supply of homes on the market at the prevailing sales pace. Relative to all supply, the condo market had the biggest challenge in 2008 when it would have taken 15.8 months to sell all available inventory at the prevailing sales pace.

- The ten year August average national months supply is 7.5 while single family is 7.3 and condos are 8.8 months supply.

View the full Aug 2016 EHS Over Ten Years slides.

Powered by WPeMatico